Hedging is used in different areas of investment but let’s focus on the binary options trading. As the term infers “binary”, we will be dealing here the two commands that require hedging. The Two Commands to Hedge in Binary Options Trading. There are two commands in the binary options trading, the call, and put options. The call option is the rights to buy but without an obligation to do 5. 3. · There are numerous additional binary options that can be used to create a hedge portfolio. A hit or miss option can be use to specifically protect both long and short positions. A miss option can even act like a covered call. Again when looking at the long EUR/USD position, a trader could purchase a miss option above the market 3. · Why Binary Options Hedging doesn’t Suck. Simple: it limits loss. The risk is decreased and for me decreasing risk is better than increasing the profit. On an un-hedged position, the potential loss is $85 but on the hedged combo, the loss is limited to $Estimated Reading Time: 4 mins

Binary Options Hedging Strategy - Binary

Speaking about the disadvantages of binary options tradingthe main thing is that traders always loses more money than winning on the deal. You will ask, is there a way to change it? Is there any possible outcome to even doubling earnings? The answer to these questions is similar and very simple — hedging of transactions. So why the trader always loses more? So for example, when executing transactions on the exchange, the probability of loss of binary options hedging funds will always be more than profit.

This is because buying the contract trader constantly pays the fees, so, he already has a small loss when binary options hedging the deal. This assertion is equivalent works with binary options, binary options hedging, as after the closing the deal with profit, the trader gets always less than the could loss.

In this case, binary options hedging, not to be at a loss, more than half of trades held by the trader should be closed with a positive result, binary options hedging. However, the ratio of profitable trades to unprofitable should be aboutthat is, if the trader wishes for beneficial result, ie the trader hsa to have not more than three of the negative results in a series of 10 trades given the fact that the percentage of payout is quite high. With the aim to reduce the impact of trade costs on the final financial result, use different strategies to reduce risks.

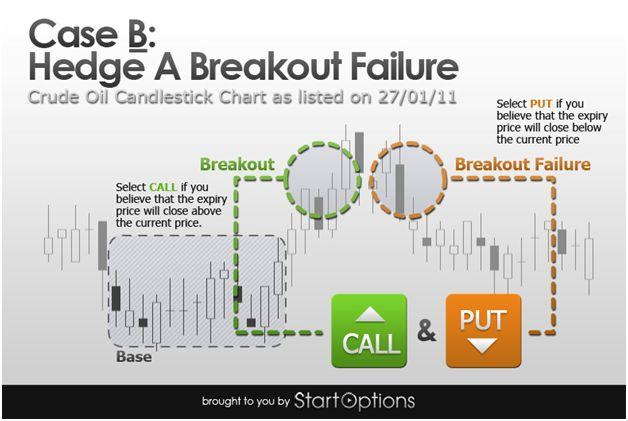

By far the most common and time efficient way to minimize risks is hedging. The purpose of this method is the insurance of the trader from incurring potential losses on deals. But with all this, it is possible to reduce the expected profit, binary options hedging, as it is the opposite depends on the magnitude of risk. However, in some cases, this method gives the opportunity to the trader double the profit from the transaction.

Trader has to understand that hedging should be more accurately viewed as a method of capital management than as a one of trading strategies. Out-of-The-Money OTM is an option without any internal value at the time of the transaction, binary options hedging. It attests to the fact forecast made by the trader was not justified or is not justified at binary options hedging current time. In this case the trader will lost the amount invested in the option.

Therefore, for Call option the real price is below the strike price, while for a Put option — above the strike price. It is considered that the option remains deep in the loss, when difference between the exercise price and the real price is quite large. At-The-Money ATM — leads to a zero result, in the case of immediate execution. This situation may occur if the current price of the instrument is equal to the strike price.

But this is quite common on the market situation, as do occasionally get to make a deal for the same price. In-The-Money ITM — leads to a positive outcome of the transaction, in the case of immediate execution, binary options hedging. Speaking about a Put option — the price will be in the opposite sense, with position below the strike price. It is considered that the option is deep in the money, when the price has gone far.

However, the strategy provides the trader a new signal, the inverse of the first signal, binary options hedging. There are a number of different reasons, for example: the weakening of its trend.

In addition, defining the expiry time same as in first transaction in order both of the options were performed at the same time. Hedging is a great way to leveling the risks associated with binary options trading. The use of this method for binary options extends the capabilities of the trader and sometimes gives the chance to double the expected profit.

This strategy is equally good in the case of using short-term and long-term options. A critical point here would be that if trader carefully checked allows the broker to quickly and easily manage the period of expiration and buying an option at short period of time.

OPEN DEMO ACCOUNT. Your email address will not be published. WAYS TO HEDGE BINARY OPTIONS Out-of-The-Money OTM is an option without any binary options hedging value at the time of the transaction, binary options hedging. Related Content What you need to binary options hedging about day trading? What is it? Will they be so popular?

Signals and Recommendations Leave a Reply Cancel reply Your email address will not be published. Pin It on Pinterest.

DOUBLE CALL PUT - 99% WORK WITHOUT LOSS

, time: 6:20Hedging with Binary Options | Juliana's Guide

3. · Why Binary Options Hedging doesn’t Suck. Simple: it limits loss. The risk is decreased and for me decreasing risk is better than increasing the profit. On an un-hedged position, the potential loss is $85 but on the hedged combo, the loss is limited to $Estimated Reading Time: 4 mins 5. 3. · There are numerous additional binary options that can be used to create a hedge portfolio. A hit or miss option can be use to specifically protect both long and short positions. A miss option can even act like a covered call. Again when looking at the long EUR/USD position, a trader could purchase a miss option above the market · Binary Options Hedging Strategy In brief, hedging is the process of mitigating, preventing and controlling risks. For instance, an insurance cover is a hedge against disasters. In binary options trading, binary options hedging is best illustrated by going long on an asset and short on a competing blogger.comted Reading Time: 2 mins

No comments:

Post a Comment