4/30/ · MT4 and MT5 indicators are technical analysis tools. In a simple language, custom forex indicators are mathematical formulas enabling traders to identify market trends. Traders use these tools for their trend predictions and speculations. AtoZMarkets Indicators gallery includes many powerful custom indicators 5/3/ · Yagub Rahimov has created a new Strategy by combining 2 indicators which generates results like a MAGIC, hence he calls it AtoZ Magic Forex Strategy. It is worth noting that the author does not claim copyrights on the Pivot Point indicator, however the Custom AtoZ indicator is a special stochastic indicator that is aligned according to the Fibonacci sequences 10/16/ · How Many Types of Forex Indicators Are? There are countless technical indicators available to choose from. In technical analysis, most Forex indicators fall into one of the three categories, as follows: Leading Forex indicators (Parabolic SAR, RSI, Stochastic) Lagging Forex indicators (Moving Averages) Confirming Forex indicators (On-Balance Volume)Estimated Reading Time: 10 mins

A to Z of Forex Trading - Latest Forex Rates

An increase in the value of currency due to a favourable market reaction or an increase in the value of a general asset. The act of taking two a to z forex indicators and opposite positions on the same currency pair at the same time to benefit from small price variations between related markets.

Because these variations are very small, this is generally only beneficial if you have a large amount of money in the trade.

Some traders consider price breaching either line forming the channel a strong signal either to enter a buy or sell position. A break through the upper trendline to buy, whilst a a to z forex indicators through the lower trendline to sell.

The LIFT Trading Method will generate an earlier trade entry opportunity — maximising your profit from each trade, a to z forex indicators. A Bullish pattern created by connecting two or more successively higher swing lows. This creates an upward sloping trend line that acts as Support in a Rising Market. A Bullish Chart Pattern that indicates a strong upper resistance to price movement with increasingly higher support swing lows.

The theory behind this chart pattern is that; with the strong upper resistance at a particular price point a double zero number — e. The price at which the market sells a currency. The trader can BUY the base currency at this price. This is a to z forex indicators right hand side figure in price window, a to z forex indicators.

An unconventional measure used by a central bank to stimulate an economy. Most recent examples are the purchasing of government bonds to lower interest rates, inject capital into the economy or both. Measures implemented by a government to reduce spending in order to lower their deficit. Usually involve wage cuts and tax increases — a political attempt to reassure creditors that they will be able to pay back outstanding loans. The currency of Australia. A to z forex indicators code AUD The Australian dollar is one of the top 6 traded currencies.

It has four major points- the high and low prices which form the vertical bar, the opening price is marked as a small horizontal line on the left side of the bar, and the closing price is marked as a horizontal line on the right. As such, this indicates in the price how many of the other currency in the pair is 1 of the base currency worth.

A term used in the UK and Australia for the rate used by a to z forex indicators banks to calculate the Interest rate to borrowers. These include the Bearish Engulfing Pattern, the Harami, Dark Cloud Cover, the Evening Star and the Shooting Star. Bearish Reversal Candlestick Patterns should form in an uptrend and will require Bearish Confirmation as reinforcement of the pattern, a to z forex indicators.

A Japanese Candlestick Pattern which identifies the potential of a price trend changing from Bullish to Bearish. An even stronger signal occurs when the bearish candle engulfs the bodies of two or three previous candles.

if the GBP USD Bid Price is 1, a to z forex indicators. An agent a to z forex indicators company who executes orders to buy and sell currencies and related instruments for their clients. Brokers are agents working on commission and not principals or agents acting on their own account, a to z forex indicators. In the foreign exchange market, brokers tend to act as intermediaries between banks bringing buyers and sellers together for a commission paid by the initiator or by both parties.

There are four or five Global Brokers operating through subsidiaries, affiliates, and partners in many countries, a to z forex indicators. These include the Bullish Engulfing, the Piercing Pattern, the Harami, the Hammer, a to z forex indicators, the Inverted Hammer, the Morning Star, the Bullish Railway Tracks and the Abandoned Baby. To use Bullish Reversal Candlestick Patterns successfully, a to z forex indicators, look for the pattern in a downtrend and use Bullish Confirmation as reinforcement of the pattern.

A Japanese Candlestick Pattern which identifies the potential of a price trend changing from Bearish to Bullish. An even stronger signal occurs when the bullish candle engulfs the bodies of two or three previous candles. Also known as a Japanese Candlestick Chart, as this is where this style of charting method originated. More information about Candlestick Charts that specifically relate to forex trading can be found in the Candlestick Module of The LIFT Investor Trader Program.

Placing an order to take an advantage of position swap rates and also the positive movement in the currency pair. Typically used by traders to take leveraged short term investment positions in highly volatile markets. Allows Traders to take short term positions with other Traders as to whether the price of an commodity will rise or fall. By doing this, your profits will generate a higher level of profit for you and; therefore, a to z forex indicators, leverage your results, a to z forex indicators.

All successful Traders and Investors consistently reinvest a percentage of their profits because they know that this allows them to produce greater results, by taking the same effort.

The LIFT Investor Trader Program teaches members how to use this and many other strategies to increase the rewards from your actions. An agreement of trade between traders — each Contract executed has a BUY and SELL price indicated. Traders who believe the currency pair price will RISE Bullish Tradeset their BUY Price on Entry into the Contract and their Sell Price on Exit to close the Contract.

Traders who believe the price will FALL Bearish Trade set their SELL Price on Entry into the Contract and their Buy Price on Exit to close the Contract. This is used in actual currency transfers when one currency asset from one country e.

British Pound is converted into another e. Australian Dollar. This practice is illegal in the United States and frowned upon internationally, as creates an artificial distortion in currency prices. The governments of some countries are known to use this method, making their currency more difficult to trade consistently based upon technical analysis or fundamental analysis.

These pairs are how the Spot Forex Market is traded by displaying and pricing one currency against another to be used to make a trade. Currency pairs are normally shown as two abbreviated currency names, separated by a slash or side by side. These are the BASE currency on the left and a QUOTE currency or COUNTER currency on the right hand side. They include the currencies euro, US dollar, British Pound Sterling, Swiss Franc, Japanese Yen, and Australian Dollar.

The Majors make up the largest share of the foreign exchange market and are considered by The Trading Coach to be the Strongest Currency Pairs to trade, because of their strong fundamental value, their trade volume and that they are traded by the large banks and investment funds.

This day is most commonly the midnight to midnight period of the country in which the trader is based. Some charts can show the daily candle as the midnight to midnight period GMT Greenwich Mean Time or New Your Time ET. Always be aware which your broker shows you on your charts — it may impact various tools, especially Pivot Points. The LIFT Investor Trader Program teaches intra day trading techniques as a way to mitigate risk and ensure that the trader is always aware of their financial position and has the ability to enter and exit trades while minimising risk.

Day trading on the foreign exchange market is recognised as one of the most active forms of trading. The ability to enter and exit trades in a short time frame to take advantage of the smaller fluctuations in price is not for every trader.

Should decide that day trading is for you, the LIFT Investor Trader Program can teach you our proprietary LIFT trading method that is used by all of our active LIFT Traders to trade Intra Day. Please be aware that here are many different styles and variations of day trading with the currency market outside this program. The lack of a real body with equal open and close prices indicates indecision between buyers and sellers — with a potential shift in the current buying or selling pressure.

A three candle bearish reversal pattern similar to the Evening Star. The next candle opens higher, trades in a small range, then closes at the same price as its open Doji. The next candle closes below the midpoint of the body of the first candle. A bearish reversal pattern that has the potential to take a to z forex indicators upwards price movement into a bearish retracement or trend reversal.

The LIFT Trading Method uses candlestick chart patterns as added confirmation of Price Trend Retracements or Reversals. Forex Trading Successfully is about making PROFIT when transacting into and out of a currency contract. A situation in which a majority of participants trading in the same asset are either long or short, leaving few investors to take the other side of the transaction when participants wish to close their positions. Leonardo Fibonacci de Pisa was a 12 th century mathematician who explained the Fibonacci sequence — a mathematical progression of numbers based upon adding the current number in the series with the previous to find the next.

The sequence starts off 0, 1, 1, 2, 3, 5, 8, 13, a to z forex indicators, 21, 34 and continues, a to z forex indicators. As the values increase, the difference between each number in the sequence calculates at Numbers in the sequence are a universal constant and appear consistently in nature, from the dimensions of the nautilus shell to the dimensions of the human face.

There is an inherent psychology to the numbers which affects according to proponents of Fibonacci the way traders enter and exit trades, based upon price movement and price cycling. Fibonacci can be utilised in many different strategies to varying benefits — More on this topic is covered in this guide and in the LIFT Investor Trader Program.

We have found that an uncomplicated approach to Fibonacci use often produces the most consistent result….

Human behaviour is not only reflected in chart patterns as large swings, small swings or trend formations. Human behaviour is also expressed in peak-valley formation. Fibonacci channels make use of peak and valley formations in the market and lead to conclusions on how to safely forecast major changes in trend directions.

The secret of Fibonacci channels is to identify the correct valleys and peaks to work with. Support and resistance lines can be drawn weeks and months into the future, once the appropriate tops and bottoms in the market have been detected. Only major tops and bottoms should a to z forex indicators considered for a base line of a Channel with one or more prominent side swings. The widest swing within a time frame of the base line is used for a trigger line. Fibonacci channels are a method of predicting levels of support and resistance for a given market.

Fibonacci channels are variants of the more-popular Fibonacci retracement strategy, with retracement lines running diagonally rather than horizontally.

To generate Fibonacci channels for a chart, a trader first creates a base channel by drawing parallel lines through a price top and price bottom. The slope of the Fibonacci channel is determined by connecting either two bottoms or two tops, depending on the overall trend: in a downward trend two bottoms are connected, while in an upward trend the slope is generated from two tops.

Once the base channel is drawn, additional parallel lines are drawn above or below it, with the distance between lines determined by Fibonacci numbers: 0.

These Fibonacci channels determine the support and resistance levels for the market within a to z forex indicators overall trend. When used, Fibonacci channels are often drawn along with Fibonacci retracement charts.

The points where the diagonal lines and horizontal lines cross are considered to be exceptionally strong levels of support or resistance for the market. The study of Fibonacci can be all consuming and it can often times be easy to get caught up in one aspect of the study. Fibonacci extensions are, as the name indicates, not a separate Fibonacci Studies in their own right, but rather a way to increase the utility of Fibonacci retracements over time.

Fibonacci extensions are created by first generating a Fibonacci retracement chart for a market. Once a basic Fibonacci retracement is created, a Fibonacci extension can be created by extending the vertical and drawing additional horizontal lines through it at higher or lower price levels, corresponding to greater Fibonacci-significant percentages: Once a Fibonacci level is met and broken through, that level becomes support, a to z forex indicators, with the following Fibonacci level becoming resistance.

THE BEST FOREX INDICATORS (Use These 2 Indicators Or Struggle FOREVER!)

, time: 8:58AtoZ Magic Forex Strategy

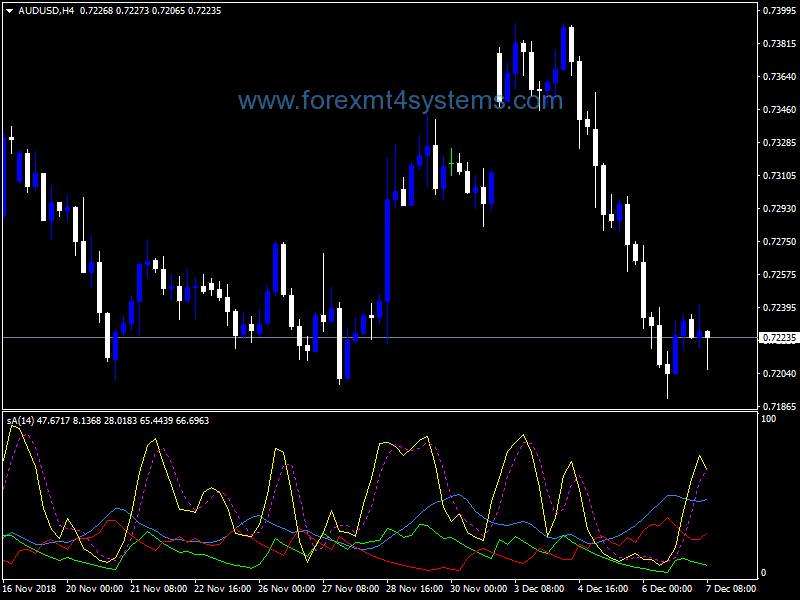

5/3/ · Yagub Rahimov has created a new Strategy by combining 2 indicators which generates results like a MAGIC, hence he calls it AtoZ Magic Forex Strategy. It is worth noting that the author does not claim copyrights on the Pivot Point indicator, however the Custom AtoZ indicator is a special stochastic indicator that is aligned according to the Fibonacci sequences 10/16/ · How Many Types of Forex Indicators Are? There are countless technical indicators available to choose from. In technical analysis, most Forex indicators fall into one of the three categories, as follows: Leading Forex indicators (Parabolic SAR, RSI, Stochastic) Lagging Forex indicators (Moving Averages) Confirming Forex indicators (On-Balance Volume)Estimated Reading Time: 10 mins Fundamental traders use fundamental leading indicators, such as economic growth, interest rates, employment figures, export and manufacturing / primary production figures as “leading indicators of the strength of a currency”

No comments:

Post a Comment