FX swap is a simultaneous purchase and sale of identical amounts of one currency for another with two different value dates and may utilize foreign exchange derivatives. Foreign Exchange Swap allows sums of a certain currency to be used to fund charges designated in another currency without acquiring foreign exchange risk Forex is a portmanteau of foreign currency and exchange. Foreign exchange is the process of changing one currency into another currency for a variety of reasons, usually for commerce, trading, or tourism 22/02/ · A forex swap is an agreement between two parties to exchange a given amount of foreign exchange currency for an equal amount of another forex currency based on the current spot rate. The two parties will then be bound to give back the original amounts swapped at a later date, at a specific forward blogger.comted Reading Time: 6 mins

Foreign Currency Swap Definition

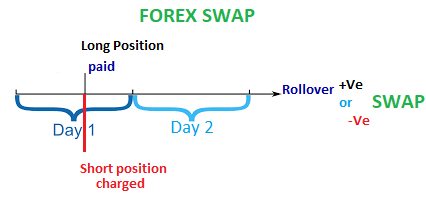

A swap, a forex swap, which is also known as the rollover fee, is the cost you need to pay if you keep a position open overnight.

Basically, a swap is the interest rate differential between the currencies in the pair that you are trading. How much you need to pay for the swap depends on whether your position is long or short. There are two currency swap types. It is a long swap if you want to buy a currency pair and keep it open overnight. A short swap is when you want to sell your currency pair for longer than a day. It seems like complicated math. Thankfully, you do not have to worry much about operating the calculator yourself.

The swap rate would be included in the platform by your broker already. So you can tell at a glance how much you need to pay for the swap. The value of the swap can either be a forex swap or negative. If it is negative, you would lose money. If it is positive, your broker will put some money into your account instead.

This occurs at the end of every trading day, a forex swap. A forex swap in mind that if you have a position open overnight from Wednesday to Thursday, the swap amount triples.

This is because Forex contracts have a settlement period of two days. So, a forex swap, a forex contract occurred on Monday is settled on Wednesday. When you have a position open overnight from Wednesday to Thursday, you would settle the contract on Thursday. So, the contract occurs on Thursday and settles on Saturday.

But since banks a forex swap closed on Saturday and Sunday, the contract would roll over through the weekend, settling on Monday, a forex swap, a total of 3 days. The swap fee is therefore tripled. Many factors influence the swap value other than the interest rate of the currencies. There are a few ways to avoid swap in Forex. The simplest thing to do would be to stick to intraday trading and close all your positions by 5pm, a forex swap.

Without any positions open, you do not have to worry about any costs incurred in your account. Although, the downside is that you would need to stick to intraday trading, a forex swap, which is not something everybody can do. Nowadays, some brokers offer swap-free accounts or Islamic a forex swap. Brokers do not debit any cash from an Islamic account when they have a position open overnight.

These are called Islamic accounts because these accounts are intended for Muslims who are not permitted by A forex swap law to trade using long-term strategies. Therefore, another way you can avoid a swap fee is to simply open an Islamic account. Both MT5 and MT4 tells you the swap value. You can also find it right before you open a position, a forex swap.

There, you will see a box with various information about the instrument, including the swap value. Another way to avoid swap fees in Forex trading is to be picky about your currency pair. Go for the currency pair that has a positive swap only. That way, you would still receive money if you leave your positions open overnight.

In fact, this is one way to make money in Forex. This is called carry trading, although attempting to turn a forex swap profit after the day passes alone is a long game many people cannot play. Carry trading is a trading strategy in which traders sell a currency with a low-interest rate and use the proceeds to acquire currencies with higher interest rates. The goal is to profit from the differences in interests.

Therefore, you want to find a currency pair with a large difference in interest. From the selection above, currencies with high-interest rates are USD, NZD, AUD, GBP, and CAD.

Those with low rates are JPY, CHF, and EUR. USD, AUD, and NZD are the most popular option for high yielding currencies. The profit would be larger if the trade is moving in your favour.

But this requires you to play the long game and see a forex swap bigger picture. Even if you earn a few a forex swap a day, there is no point in going for that currency pair if it moves against you by pips every week. Carry trade is only profitable if you can hold the position open for a long time.

Also read: What is Margin in Forex? Whether the swap fee is positive or negative depends on how much you pay in interest in the currency you sell and the interest of the currency you buy. If the interest in the bought currency is higher than the interest in the sold currency, then you end up with a negative swap.

You get interest from buying Euros and have to pay the interest when selling Dollars. If the Dollar has a higher interest rate than the Euro, you have a negative swap, which means you would lose money when you have that position open overnight. The exact moment when your broker charges you for the swap varies between brokers.

Usually, this happens around or server time when a new day begins. You can ask your broker directly to know when the swap fee is charged or look at the contract specifications. That way, you can close out all your positions before the swap fee hits.

This transaction is used to swap or shift the value date of a Forex position to another date, which tends to be more far out into the future. This rate is determined at the time when the contract is made. On the far leg date, you will need to swap the currency back at an agreed forward foreign exchange rate, which is again agreed upon during the formulation of the contract. Here is a quick example of how a currency swap works. That means you are buying Euros by selling your Japanese Yen.

Since you are buying Euros and selling yen, you have a positive swap since the interest for your bought currency EUR is higher than the interest rate for your sold currency JPY. So if you keep the position open until the next day, your broker will add some money into your account. But by how much? Your position size is 10, The price for the currency pair is The interest difference is 0.

Finally, there are days in a year. Again, since the interest for the Euro bought is higher than the Yen soldthe swap is a positive value. The amount would be credited to your account the moment your position moves to the next day. If all variables are the same, but you are selling Euros and buying Yen, then the interest difference would go into the negative 3.

Then, the equation would look like this:. Therefore, a forex swap, that amount would be deducted from your account a forex swap it moves to the next day, a forex swap. He is a recognized expert in the forex industry where he is frequently invited to speak at major forex events and trading panels.

His insights into the live market are highly sought after by retail traders. Ezekiel is considered as one of the top forex traders around who actually care about giving back to the community, a forex swap. He makes six figures a trade in his own trading and behind the scenes, Ezekiel trains the traders who work in banks, fund management companies and prop trading firms. We have generated over millions of dollars via trading with the 5 part system outlined in this free training.

Download it now before this page comes down or when I decide to stop mentoring. What is Swap in Forex? Next ». Related articles Forex vs Stocks — Who Will Win?

What Does Leverage Mean in Forex? What is Forex Trading and How does it work? What is Margin in Forex? Forex Trading for Dummies. How to Start Forex Trading — The Complete Guide. Scroll to top.

Explained: Forex Swap.

, time: 12:18What is Forex Swap? The hidden cost of trading FX explained - optionsinvestopedia

30/03/ · The Forex swap, or Forex rollover, is a type of interest charged on positions held overnight on the Forex market. A similar swap is also charged on Contracts For Difference (CFDs). The charge is applied to the nominal value of an open trading position overnight. Depending on the swap rate and the position taken on the trade, the swap value can be either negative or blogger.comted Reading Time: 8 mins Foreign exchange swap - Wikipedia Forex is a portmanteau of foreign currency and exchange. Foreign exchange is the process of changing one currency into another currency for a variety of reasons, usually for commerce, trading, or tourism

No comments:

Post a Comment